rutile titanium dioxide price factory

The Dynamics of Rutile Titanium Dioxide Prices

Rutile titanium dioxide, a key pigment used across various industries, has garnered attention in recent years due to its unique properties and increasing global demand. As industries such as construction, automotive, and consumer goods expand, understanding the pricing dynamics of rutile titanium dioxide becomes crucial for manufacturers, consumers, and investors alike. This article delves into the factors influencing the price of rutile titanium dioxide and the implications for stakeholders.

Understanding Rutile Titanium Dioxide

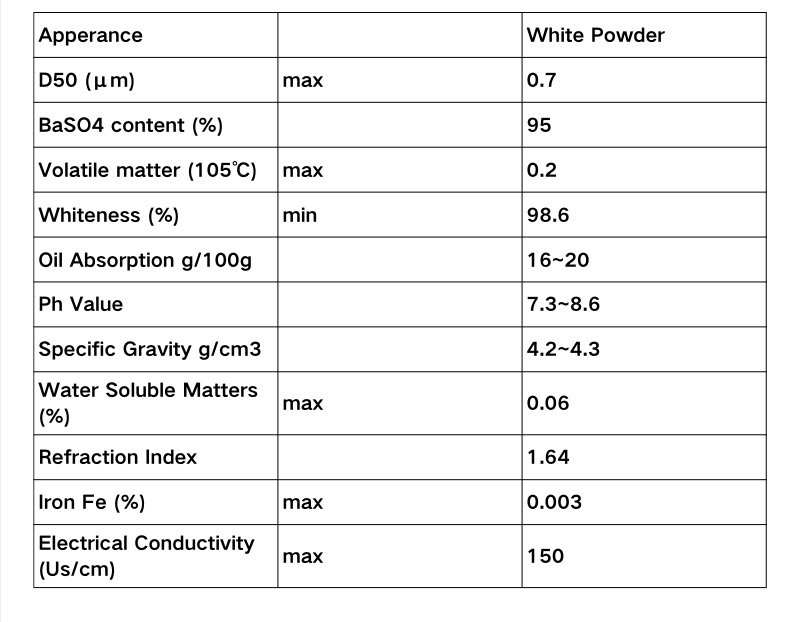

Rutile is one of the three primary forms of titanium dioxide, the other two being anatase and brookite. Among these, rutile titanium dioxide is the most widely used due to its superior optical properties, durability, and strong refractive index. These characteristics make it an ideal choice for use in paints, coatings, plastics, and even in specialized applications like pharmaceuticals and food products.

Key Factors Influencing Prices

1. Raw Material Supply The primary source of titanium dioxide is the mineral ilmenite, which is processed to extract titanium. Fluctuations in the availability of high-quality ilmenite can significantly affect the production costs for rutile titanium dioxide. Supply chain disruptions, geopolitical tensions, and environmental regulations also contribute to the volatility of raw material prices.

2. Global Demand The demand for rutile titanium dioxide is driven by various industries. The construction sector, for example, requires high-quality pigments for paints and coatings due to urbanization and infrastructure development. Similarly, the automotive industry's shift towards more vibrant colors and finishes increases the demand for high-performance titanium dioxide. Trends towards sustainability and eco-friendly products further amplify the need for superior coatings, influencing the overall prices.

rutile titanium dioxide price factory

3. Production Capacity and Costs The production of rutile titanium dioxide involves complex processes, including the sulfate and chloride methods. Variations in production costs, whether due to technological advancements or changes in energy prices, play a significant role in determining market prices. Moreover, factories that implement more efficient and environmentally friendly processes may have a competitive edge, impacting pricing strategies.

4. Market Competition The titanium dioxide market is characterized by a relatively small number of dominant players and a competitive landscape. Major manufacturers often engage in price wars to capture market share, but fluctuations in costs can lead to price stabilization or escalation. Monitoring the actions of key players is essential for forecasting price trends.

Price Trends and Projections

Historically, rutile titanium dioxide prices have shown considerable volatility. In recent years, prices have experienced upward pressure due to increased demand and supply chain challenges exacerbated by global events such as the COVID-19 pandemic. As industries rebound and expand, it is expected that the prices may stabilize, albeit at a higher baseline owing to the inherent supply chain complexities.

Industry analysts predict that as environmental regulations tighten globally, the shift towards more sustainable practices will likely result in increased production costs. While this may lead to higher prices in the short term, it could also stimulate innovation, driving manufacturers to invest in cleaner technologies, which could ultimately benefit the market in the long run.

Conclusion

The pricing dynamics of rutile titanium dioxide reflect a complex interplay of supply and demand, production costs, and market competition. For stakeholders, including manufacturers and investors, staying attuned to these trends is crucial. As industries continue to evolve and environmental considerations become more prominent, the future pricing of rutile titanium dioxide will undoubtedly be influenced by these overarching factors. Understanding these dynamics will not only help in strategic planning but also provide insights into market movements, ensuring informed decision-making in this vital sector.

Share

-

Premium Pigment Supplier Custom Solutions & Bulk OrdersNewsMay.30,2025

-

Top China Slag Fly Ash Manufacturer OEM Factory SolutionsNewsMay.30,2025

-

Natural Lava Rock & Pumice for Landscaping Durable Volcanic SolutionsNewsMay.30,2025

-

Custom Micro Silica Fume Powder Manufacturers High-Purity SolutionsNewsMay.29,2025

-

Custom Mica Powder Pigment Manufacturers Vibrant Colors & Bulk OrdersNewsMay.29,2025

-

Custom Micro Silica Fume Powder Manufacturers Premium QualityNewsMay.29,2025